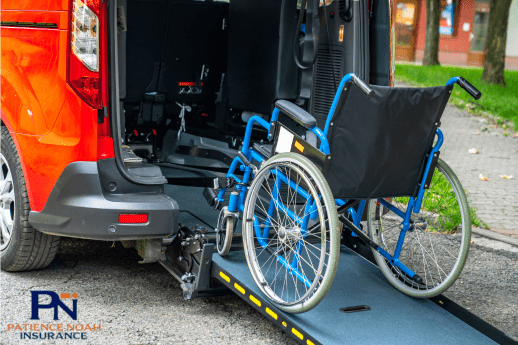

Non-Medical Transportation Insurance

Protect Your Passengers, Protect Your Business: Non-Medical Transportation Insurance Policies

Get a FREE Quote now!

What is Non-Medical Transportation Insurance?

Insurance for non-medical transportation is a for-hire insurance policy that caters to companies that help transport patients in a non-medical situation. NEMT insurance protects your company across multiple areas, encompassing general liability insurance, commercial auto insurance, worker’s compensation, umbrella insurance, employment practices liability, and professional liability.

Why Do I Need NEMT Insurance Solutions?

Comprehensive Coverage

This type of transportation insurance first provides comprehensive coverage to your business.

This protection is against any unforeseen circumstance, such as an accident, bodily injury, or theft.

Tailored Solutions

Moreover, we provide tailored solutions for your company’s needs and requirements.

Your satisfaction is a priority for us, and we make sure to offer special bundles and packages that suit your NEMT program.

Risk Mitigation

By choosing the non-medical transport insurance at Patience Noah, you promise a secure and safeguarded business with smooth processes in case of risks and general liabilities.

Regulatory Compliance

As a wise business owner, it’s necessary to comply with all regulations and legal requirements of your country. Non-emergency transportation insurance requires proof of insurance in all states by law. It is a sound decision to invest in if not all, but some insurance solutions to provide safety and gain the trust of your customers.

Financial Protection

Let’s pay attention to the primary benefit of obtaining NEMT insurance: ensuring financial security for your business. Who would prefer to avoid protecting their assets after investing their blood and sweat in a company? You will surely choose the insurance to ensure your passengers’ safety.

To answer all your queries regarding NEMT insurance, our customer support is available 24/7

Are you concerned about the expenses associated with non-emergency medical transportation insurance?

Take a deep breath, as our customer support agents are ready to tackle all your problems.

Put up any questions and confusion about the insurance plan, and get your custom quote now!

The Different Insurance Policies for non-emergency medical insurance are listed below:

1. Commercial Auto Insurance

The commercial auto insurance policy is tailored to safeguard your business interests and offers coverage for vehicles utilized in your transportation operations.

2. Umbrella Insurance

Umbrella insurance extends additional liability coverage beyond the confines of primary insurance policies, effectively shielding the company from more significant claims and lawsuits.

3. Medical Payments Coverage

Medical payments coverage is an optional coverage option that pays for bodily injury to passengers or drivers during the trip.

4. Business Interruption Insurance

As the name suggests, if transport is interrupted due to a vehicle breakdown or facility damage, business Interruption insurance covers the lost business.

5. Cargo Insurance

Cargo Insurance covers the goods or medical equipment being transported by your NEMT company, so any loss or damage during transit will be covered.

6. General Liability Insurance

As its name suggests, this insurance plan covers all general liabilities that could cause you (the business owner) problems in the future. General liability coverage insulates you when a bodily injury occurs, vehicle damage, theft, or vandalism occurs.

7. Professional Liability Insurance

Professional liability insurance is typically error and omission insurance. To explain in simpler terms, let’s say you are a NEMT provider, and you scheduled an incorrect time for an appointment for a patient’s pick-up.

Professional liability coverage will help you in this case of error from your side by protecting you against any legal claim or lawsuit/acceptable from the customer. See this insurance plan as more of a safety net for your business.

8. Worker’s Compensation Insurance

This insurance policy applies to you if your NEMT company has employees. Worker’s compensation insurance covers medical expenses and lost wages if employees are injured or become sick while on duty.

Although the insurance policies listed above are basic for NEMT service providers, it’s understandable that different companies will have specific needs, and thus, choosing the insurance policy that caters to you is important.

Ensure Smooth Rides: Tailored Insurance Solutions for Non-Medical Transportation

Choose your company’s future by opting for Patience Noah insurance. Get your custom quote now!

At Patience Noah, we have industry expertise in providing non-medical transport insurance solutions to companies.

We provide this insurance using our industrial expertise and thorough processes.

At Patience Noah, your satisfaction is a priority. Reach out now or call on the given number!

Companies We Represent